Quite often, it’s the parents who sit down for “the talk” when kids start growing up, usually about money, responsibilities, and becoming independent. As young adults, we’re told how important it is to be financially smart, save early, and plan for the future. But what happens when that conversation flips ?

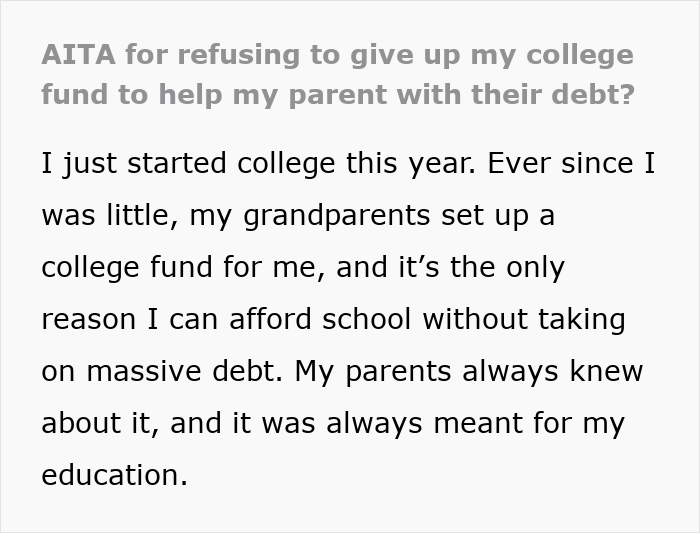

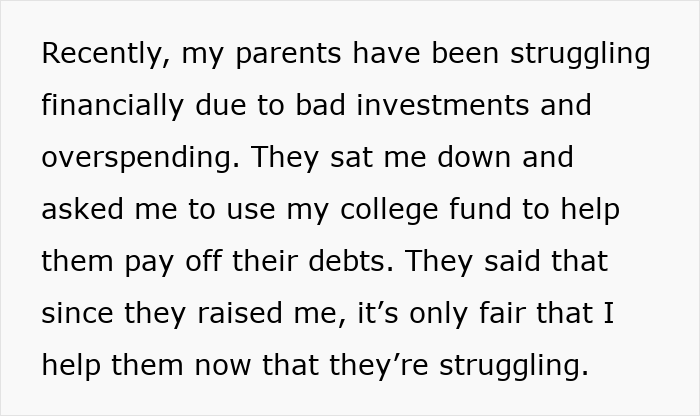

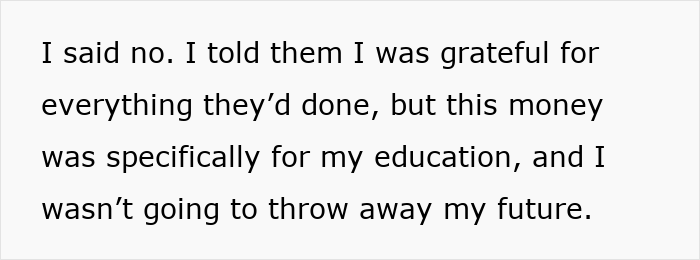

For instance, a college freshman shared how her parents, struggling with debt, asked her to give up her education fund to help them out. When she refused, choosing to prioritize her future, they accused her of being selfish and now barely speak to her. Keep reading to see how people reacted to her difficult but brave decision.

Sometimes parents unintentionally burden their children with responsibilities that aren’t really theirs to carry

Teen refuses to sacrifice her future during a tense discussion with her upset parents about financial mistakes at home

A college freshman opened up about how her parents mishandled their finances and expected her to cover their debts

Text post about a teen refusing to sacrifice her future by using her college fund to fix parents’ financial mistakes.

Teen refusing to sacrifice future by using college fund to fix parents’ financial mistakes, facing family conflict.

Teen refuses to sacrifice her future for parents’ financial mistakes, explaining her education money is untouchable.

Teen counting money with planner open, symbolizing refusal to sacrifice future for parents’ financial mistakes.

Teen refuses to sacrifice her future to fix parents’ financial mistakes, causing family conflict and emotional upset.

Text on screen showing a teen refusing to sacrifice her future due to parents’ financial mistakes and strained relations.

Teaching teens how to budget is one of the most effective ways to help them manage money wisely

In this case, the girl was fortunate; her grandparents had set aside a college fund for her. However, not every teen has that safety net, especially in countries like the USA, where the cost of education often lands directly on young shoulders. It’s in these moments that financial education from parents becomes critical. Teaching teens how to handle money, set goals, and make smart decisions lays the foundation for adult responsibility. It’s not just about saving, it’s about understanding value.

To understand this better, Bored Panda spoke with Khushboo Dugar, a chartered accountant from India with deep experience in financial planning and tax advisory. She’s also a mom of two, which means she brings both professional and personal insight to the table. “It’s never too early to start talking about money,” she says. “In fact, the earlier the better.” Teaching kids to be financially literate doesn’t mean burdening them, it’s about empowering them. And Khushboo believes this is something every family should prioritize.

“Budgeting is where it all begins,” Khushboo explains. “It’s the most effective way for teens to learn money management.” She recommends involving them in real conversations about income, expenses, and goal-setting . Understanding that money isn’t infinite is a vital lesson. It helps them recognize what’s essential and what can wait. When they learn to divide money into categories, saving, spending, and giving, they start making more thoughtful choices.

“If your teen doesn’t have a job during the school year, give them structure,” Khushboo says. “Offer an allowance in exchange for chores or babysitting, even for good grades.” This helps them understand that money comes from effort. It’s not just handed out, it’s earned. And when they associate effort with reward, they treat money with more care. This builds a sense of responsibility and encourages independent thinking early on.

Tracking expenses is another powerful habit teens should develop. “It’s not about controlling every rupee or dollar,” she adds, “but about knowing where your money goes.” If a teen wants a new phone or gaming console, they should be taught how to set a savings goal. It makes the purchase more meaningful. Plus, it’s a great opportunity to talk about delayed gratification. Understanding the concept of saving over time builds patience and planning.

“Balancing their goals with financial reality is key ,” Khushboo shares. “It’s not about saying no to what they want, but helping them see what’s realistic.” This can apply to everything from vacations to weekend outings. She encourages parents to be honest and transparent. When teens understand the family’s financial boundaries, they learn how to adapt. And that’s a skill they’ll use well into adulthood.

She also recommends discussing long-term plans like college early on. “Sit down and talk about their goals, what college they want to go to, what it might cost, and what options exist.” This helps teens feel part of the decision-making process. Whether it’s public university, private college, or online programs, it’s important to weigh the pros and cons together. “They should know it’s okay to dream,” she says, “but also how to fund that dream.”

Talking about your own financial experiences can give kids a clearer picture of responsibility and decision-making

Another essential topic is banking basics. “Talk to your teen about savings accounts, debit cards, and even student loans,” Khushboo says. Many teens don’t understand how interest works or how debt adds up. Walking them through things like opening a bank account or reviewing a bank statement can demystify finances. It gives them tools they’ll need sooner than you think. And that builds financial confidence.

“Share your own financial journey too,” she advises. “Let them know where you made mistakes and what you learned.” It makes the conversation feel more real and less like a lecture. When kids hear stories instead of just advice, they’re more likely to listen. It also creates trust, your teen will feel like you’re in this with them. And trust is what opens the door for deeper conversations later.

Credit and debit cards can also be confusing for teens. “Explain how they work, and the pros and cons of each,” Khushboo says. “Talk about interest rates, minimum payments, and building credit scores.” These things are often left until adulthood, and by then, mistakes can be costly. Teaching your teen now can help them avoid common pitfalls. It’s not about fear, it’s about preparation.

In conclusion, Khushboo believes that empowering teens with financial knowledge helps them make better choices. It’s about giving them tools, not pressure. “Start small, stay consistent, and be open,” she says. With time, they’ll grow into confident decision-makers. Because at the end of the day, financial literacy isn’t just about money, it’s about independence, resilience, and future readiness.

In this particular case, it seems like the OP was already making thoughtful financial decisions. Don’t you think so too? Do you have a teenager at home? Have you started guiding them on how to handle money or make smart choices about saving and spending? Let us know how those conversations are going, because a little guidance early on can really go a long way.

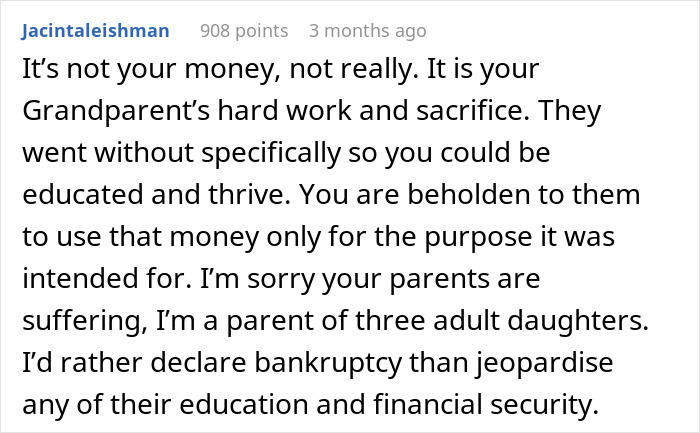

People online felt the author’s parents were acting extremely irresponsibly

Screenshot of a Reddit comment discussing a teen refusing to sacrifice her future for parents’ financial mistakes.

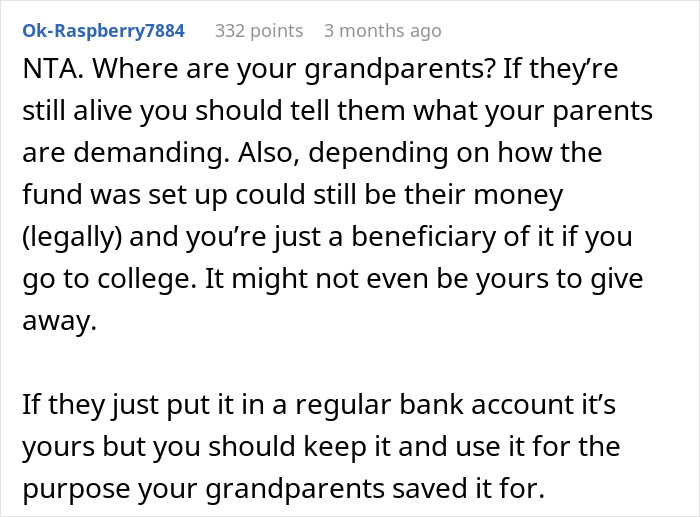

Screenshot of a Reddit comment discussing a teen refusing to sacrifice her future due to parents’ financial mistakes.

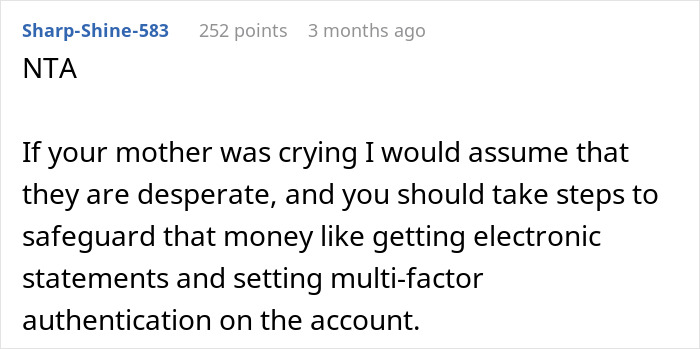

Screenshot of a Reddit comment about a teen refusing to sacrifice her future for parents’ financial mistakes.

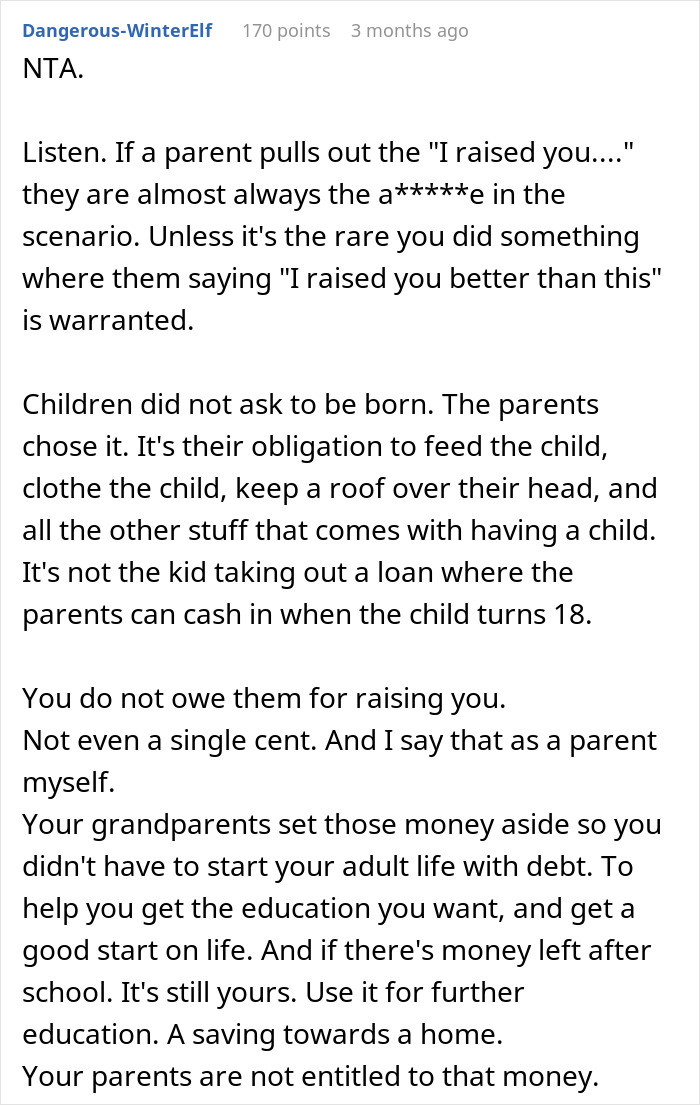

Teen refuses to sacrifice her future for parents’ financial mistakes in a heartfelt online discussion.

Screenshot of an online comment advising a teen to protect money and refuse to sacrifice future over parents’ financial mistakes.

Teen refuses to sacrifice her future to fix parents’ financial mistakes in a family conflict about money and responsibility.

Teen refusing to sacrifice her future over parents’ financial mistakes, capturing her firm stance in a digital chat post.

Comment stating grandparents set up a college fund, not a fallback fund for parents’ financial mistakes, on a discussion thread.

Screenshot of a Reddit comment discussing a teen refusing to sacrifice her future to fix parents’ financial mistakes.

Screenshot of an online comment discussing a teen refusing to sacrifice her future due to parents’ financial mistakes.

Comment discussing a teen prioritizing education over parents’ financial mistakes and refusing to pay off their debts.

Teen refuses to sacrifice her future by paying parents’ financial debts, causing family conflict and tension over money issues.

Forum comment advising a teen to keep future salary private to avoid parents impacting their financial future.

Screenshot of a forum comment about a teen refusing to sacrifice her future due to parents’ financial mistakes.

Screenshot of a Reddit comment advising a teen to prioritize education over fixing parents’ financial mistakes.

Comment discussing a teen refusing to sacrifice her future due to parents’ financial mistakes and lack of responsibility.

Comment discussing a teen refusing to sacrifice her future to fix parents’ financial mistakes with frustration over debt.

Screenshot of an online comment expressing disagreement with parents taking away a teen’s education over financial issues.

Comment on a forum stating a teen refuses to sacrifice her future to fix parents’ financial mistakes, emphasizing parental responsibility.

Screenshot of an online comment with a user discussing a teen refusing to sacrifice her future over parents’ financial mistakes.

Comment showing someone refusing to sacrifice their future to fix parents’ financial mistakes and calling parents selfish.

Comment discussing a teen refusing to sacrifice her future due to parents’ financial mistakes and their negative reaction.

Comment on Reddit discussing a teen refusing to sacrifice her future due to parents’ financial mistakes and their reaction.

Screenshot of a comment discussing a teen refusing to sacrifice her future for parents’ financial mistakes online.

Screenshot of an online comment where a user supports a teen refusing to sacrifice her future for parents’ financial mistakes.

Comment on forum expressing support for a teen who refuses to sacrifice her future to fix parents’ financial mistakes.

Teen refuses to sacrifice future to fix parents’ financial mistakes as grandparents protect education funds.

Comment on a forum discussing a teen refusing to sacrifice her future for parents’ financial mistakes, defending grandparent’s fund rights.

Comment advising teen on protecting college fund to safeguard future amid parents’ financial mistakes and struggles.

Comment explaining a teen refuses to sacrifice future for parents’ financial mistakes and encourages pursuing education.

Screenshot of online comment supporting a teen refusing to sacrifice her future to fix parents’ financial mistakes.

Comment discussing a teen refusing to sacrifice her future to fix parents’ financial mistakes and their selfish expectations.

Comment discussing a teen refusing to sacrifice her future to fix parents’ financial mistakes with advice on success.

Comment on Reddit discussing a teen refusing to sacrifice her future to fix parents’ financial mistakes.

Screenshot of an online comment advising a teen to focus on college instead of fixing parents’ financial mistakes.

Screenshot of an online comment stating refusal to sacrifice future due to parents’ financial mistakes and bad investments.

Screenshot of a forum comment discussing a teen refusing to fix parents’ financial mistakes and protecting their future.

Comment discussing a teen refusing to sacrifice her future to fix parents’ financial mistakes and advice on handling debt.

Thanks! Check out the results:

Anyone can write on Bored Panda. Start writing!

Follow Bored Panda on Google News!

Unlock an Enhanced Experience with Bored Panda Premium

Go ad-free, access unlimited content, and enjoy our sleek dark mode. Your favorite stories, uninterrupted.

No fees, cancel anytime

Olympian Makes Stunning Admission After Judge’s Conspicuous Scores Ignite Cheating Accusations